The most common business ownership structures are the limited liability company (LLC) and the corporation. LLCs and corporations function in different ways. But they are formed in the same way. Both of them require filing articles of organization with the state. Then, an LLC prepares an operating agreement, sometimes called a company agreement, that governs how the LLC runs. Corporations use bylaws for this purpose. But in some states there is a trap to forming an LLC. These states require the filing of a Notice of Formation.

Notice of Formation

The LLC has become a popular business entity. But the laws of three states include what has become an LLC trap. Many people believe that after they file their articles with the state and draft their operating agreements, they are finished. But in those three states, the LLC must publish a newspaper notice of its formation.

Why LLC Publication?

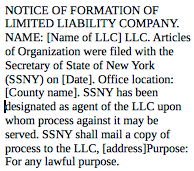

The LLC publication requirement began with legislative fears that investors and LLCs “would shift business losses to creditors and tort victims,” as Matthew J. Moisan explains beginning at page 468 of his excellent article, A Look at the Publication Requirement in New York Limited Liability Company Law. To address this concern, the New York legislature required that an LLC publish notice of its formation six consecutive weeks in both a daily and a weekly newspaper in the LLC’s county of organization. LLCs must complete publication must within 120 days of the filing of articles of organization.

New York is Not Alone

Two other states – Arizona and Nebraska – also have publication requirements. In Arizona, an LLC must publish three times in a newspaper of general circulation where the LLC does business. There is an exception for Maricopa and Pima Counties. An LLC must meet the requirement within 60 days of formation. Nebraska requires publication once a week for three weeks in a general circulation newspaper “near” the LLC”s designated office. The statute does not mention a deadline to complete publication.

Notice of Formation Trap

There are at least three problems with these publication requirements. First, they are unnecessary and increase the cost of doing business. Second, publication can be expensive, especially in New York City where meeting the publication requirement can cost around $1,000. Finally, the trap is that many web-based guides for organizing LLCs do not include the publication requirement because their authors are unaware of it.

No Notice of Formation – Consequences

If there is no LLC publication, then the LLC is not fully formed and may not longer do business. Also, the LLC can lose its liability shield. Those who form LLCs in Arizona, Nebraska and New York should be sure to meet the publication requirements.