There are many different business entities for an entrepreneur to choose from. When discussing the appropriate business entity, I usually present three alternatives. First, if the business is just beginning, I suggest the LLC. Second, if the business will seek investors, I suggest a corporation. Finally, if the business is ready for venture capital investment, I suggest a Delaware corporation. But your original choice of format is not forever binding. If you start out with an LLC, converting to a corporation, and later to a Delaware corporation, is an option.

LLCs and Corporations

An LLC is a good choice for the beginning entrepreneur. An LLC can be single member or have multiple members. But the main reasons for choosing the LLC are that it is a pass-through entity for tax purposes and the ongoing paperwork is less onerous than for a corporation. If there will be investors, they will likely insist on the corporate format because corporation law is far more developed than LLC law. LLCs have been around only since 1977 when Wyoming first passed an LLC statute. For the same reason, sophisticated investors will require an entity to be a Delaware corporation. Delaware has a long history with corporations. Its corporate law is the most developed among the states. Delaware actually has a special court, the Court of Chancery, to deal with business disputes.

Converting the LLC

The timeline for a new, small business runs something like this: The business starts small. It acquires investors as it prospers. If the owners are especially fortunate, they will attract venture capitalists. These investors will require that the entity become a Delaware corporation. Fortunately, you can start small and “convert” as things progress.

Certificates of Conversion

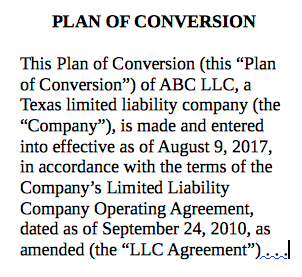

Texas and other states explicitly allow LLCs to convert to corporations. Moreover, corporations can be moved from one state to another. Delaware specifically permits out-of-state corporations to become Delaware corporations. These moves require the preparation of a Plan of Conversion. These plans govern such things as how many shares of stock should be issued in exchange for a limited partnership interest. There will, of course, be filing fees.

So start small with your LLC. Then, you can grow into a corporation if you want. Finally, perhaps you will hit a home run by becoming a Delaware corporation.