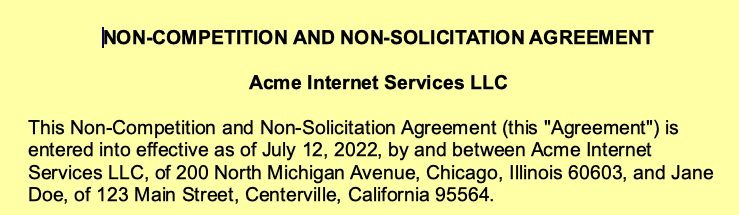

Non-Competition, Non-Solicitation & Non-Disclosure Agreements

Are you thinking about signing a non-competition, non-solicitation or nondisclosure agreement? If you are, it’s important to understand what you’re agreeing to.These agreements can have a significant impact on your ability to work in your chosen field. Thus, it’s crucial to know what you’re signing up for. In this blog post, we’ll cover their basics … Read more